Después de vacilar durante varios años, la economía del Reino Unido muestra signos de recuperación real, con un aumento del gasto, la inversión, las exportaciones e incluso el crecimiento de la industria. A principios de 2014, parece haber un círculo virtuoso de caída del desempleo, caída de la inflación y aumento del PIB.

Después de una de las recesiones más largas y profundas de la historia, estos signos de crecimiento económico son definitivamente bienvenidos, pero están lejos de volver a la normalidad. El PIB real sigue estando un 2% por debajo de su máximo de 2008, y la economía se está apoyando en tipos de interés cero, flexibilización cuantitativa y un mercado inmobiliario fuerte. Los salarios estancados y el escaso crecimiento de la productividad han dado lugar a uno de los períodos más prolongados de deterioro del nivel de vida que se recuerde. Aunque hay una recuperación económica, todavía existe el temor de que la recuperación sea desequilibrada y de que la economía del Reino Unido pueda descarrilarse por problemas en la zona euro y futuras medidas de austeridad del gobierno.

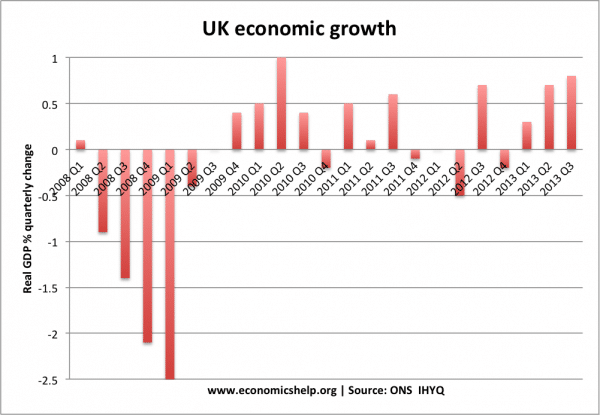

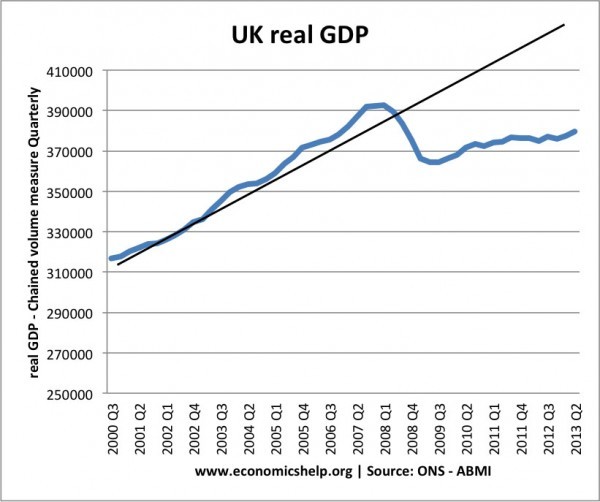

Crecimiento económico

más sobre el crecimiento económico

El ONS ha revisado recientemente el crecimiento económico anualizado para indicar una tasa de crecimiento anual del 1,9%. Todavía por debajo de la tasa de tendencia, pero bienvenido después de varios años de caída del PIB. Para 2014, el OBR prevé un crecimiento económico del 2,4% (enlace BBC)

Una pregunta difícil es cuánta brecha de producción tiene el Reino Unido. Desde 2008, el PIB se ha alejado de la tasa de crecimiento tendencial. En teoría, con una producción mucho más baja que el PIB potencial, esperaríamos que una rápida recuperación “recupere” el PIB perdido. Sin embargo, es poco probable que veamos esto. La gran recesión ha provocado, lamentablemente, una pérdida permanente del PIB real. Los economistas debaten cuánta capacidad disponible tiene el Reino Unido. Pero, por el momento, es poco probable que tasas de crecimiento del 2,5% provoquen una presión inflacionaria significativa.

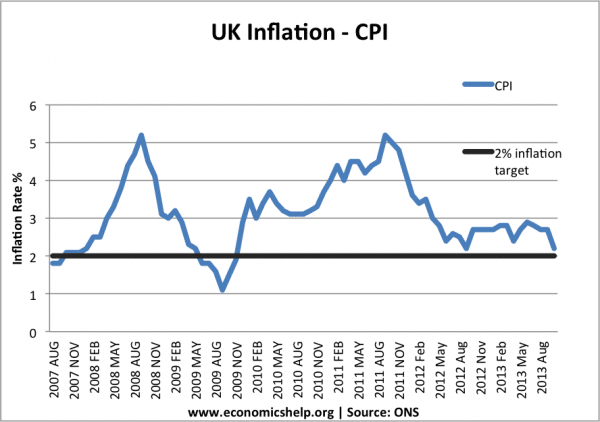

Inflación

más sobre la inflación

Es irónico que ahora que estamos experimentando una recuperación económica, la inflación general finalmente se esté acercando a la meta de inflación del gobierno. del 2%. Durante la gran recesión, la inflación estuvo a menudo por encima del objetivo debido a factores de presión de costos, como la depreciación, el aumento de los precios del petróleo y los impuestos más altos. Pero, ahora que estos factores de empuje de los costos se han evaporado, la inflación ha caído al 2,1%. Dada la naturaleza de la recuperación económica, es probable que la inflación se mantenga baja en 2014, ayudada por las bajas expectativas de inflación.

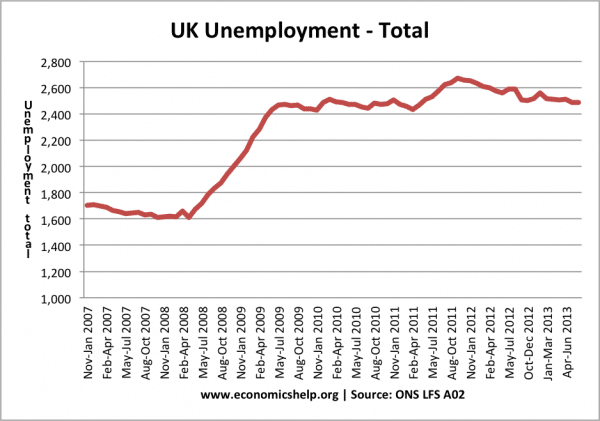

Desempleo del Reino Unido

Desempleo

En comparación con el resto de la eurozona, el desempleo en el Reino Unido casi podría considerarse una historia de éxito. El desempleo se ha reducido al 7,4% (2,39 millones). Hay un número récord de personas empleadas (más de 30 millones por primera vez)

However, whilst this unemployment rate is relatively low compared to Europe and also compared to previous recessions, there are other aspects which make less positive reading. Low unemployment has been helped by a rise in part-time employment, temporary contracts, greater job insecurity and falling productivity. (see UK Unemployment mystery) Also, there are pockets of high unemployment, especially in the north, inner cities and amongst the young. Unemployment of 2.39 million is still a serious social problem, and it will need a considerable period of economic expansion to help reduce to more manageable levels.

Nevertheless, temporary work is still better than no work. Flexible labour markets have many drawbacks, but it is quite interesting that during the shallower recessions of the 1980s and 90s, unemployment rose to a much higher level. There are also promising signs of firms hiring more workers in areas such as, marketing, sales and business development (FT link) which indicate sign of optimism.

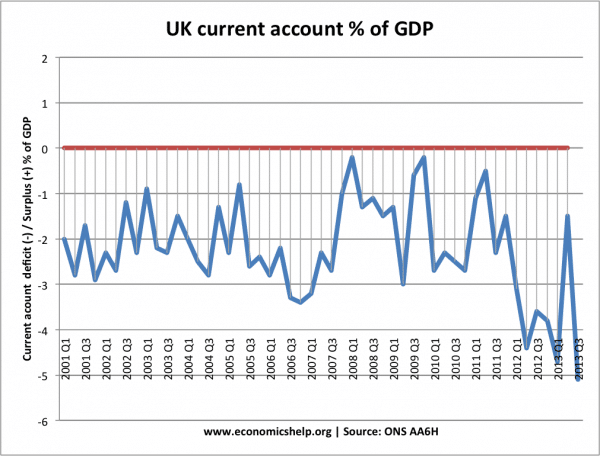

Balance of payments

Figures for the UK current account have been quite volatile in recent quarters, therefore we need to treat statistics from the latest quarter with some caution.

Nevertheless, a current account deficit of 5% of GDP at this stage of the economic cycle is a serious cause for concern. It suggests that import spending is significantly higher than exports; it reinforces the image that the UK economy is still seriously unbalanced relying on consumer spending to boost growth. A current account deficit of 5% of GDP is unsustainable in the long term, and will tend to put downward pressure on sterling over the coming months. The real challenge for the economy will be to rebalance growth away from consumer spending towards boosting exports.

On a more positive side, the UK has been relatively successful in increasing exports to emerging markets such as Russia, Brazil and China. Admittedly this is from a low base, but the diversification away from EU markets is helpful given the ongoing weakness of the Euro-economy. (UK exports to non-EU countries)

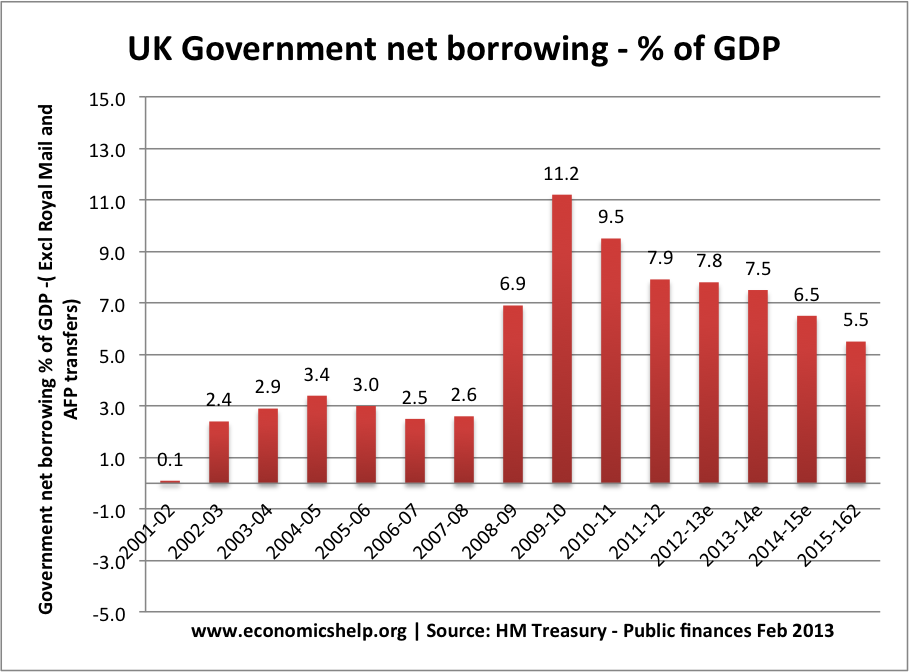

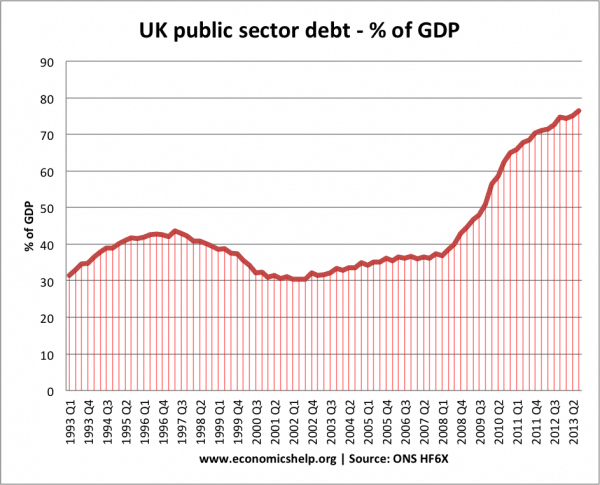

Government borrowing

2013 has seen a fall in the annual budget deficit to 7% of GDP.

However, total public sector debt has continued to rise. At the start of 2014, total government debt is equivalent to 76% of GDP.

Is this level of debt a cause for concern?

Some would argue, the rise in government debt is only to be expected given the length of the recession. The UK has had much higher debt in the past. Also, with low interest rates, the cost of government borrowing is very low. Finally, given the weakness of the private sector, it makes sense for the government to play a role in maintaining demand in the economy.

Others worry about the level of rising debt, arguing there is a need to cut budget deficits faster. The chancellor has indicated that he is seeking to cut government spending by another £25bn this year to help reduce the budget deficit. The concern is that if the government return to significant levels of austerity it may damage aggregate demand and confidence in the economy – possibly diminishing the recovery. Others argue the private sector will be strong enough to absorb the government spending cuts.

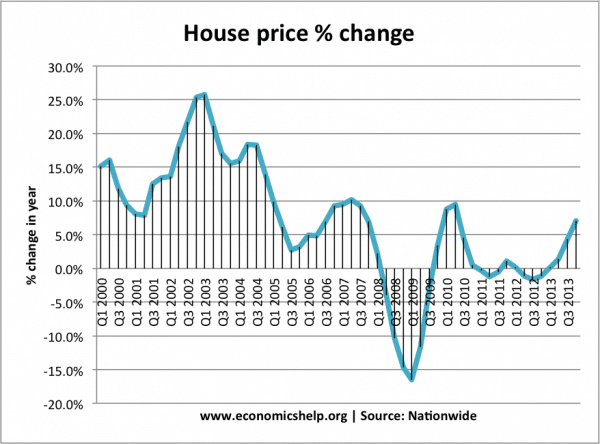

Housing Market

2013 has seen a recovery in the UK housing market. Mortgage transactions have increased (admittedly from a low base) indicating strong demand and a greater willingness of banks to finance mortgages. House prices have risen by nearly 8% (and in some areas by even more)

However, the problem is that a strong housing market is causing concern house prices are unaffordable. House price to income ratios are well above long term trends are there is a fear we are in another mini housing bubble. Rising house prices may boost consumer spending in the short-term, but it could be a volatile source of economic growth and damage labour market flexibility. Rising house prices are also increasing the cost of living for the increasing number of young people who don’t own their own home.

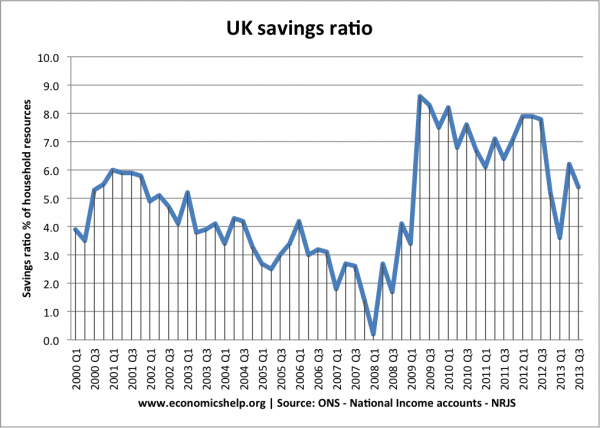

Saving ratio

Saving ratio

The saving ratio gives an indication of how much consumers are spending compared to disposable income. After the start of the recession, the saving ratio increased rapidly from near 0% to over 8%; this showed consumers wished to pay off debt and increase their savings. However, since 2012, the saving ratio has fallen as consumers have dealt with stagnant real wage growth by spending through diminishing savings. A saving ratio of 5% is still quite low for this stage of the economic cycle and is another factor that causes concern the UK has an unbalanced growth.

Reasons to be optimistic in 2014

- There are strong signs of economic growth, with the possibility of growth rates returning to the UK’s long run trend rate of 2.5%. This will cause a virtuous circle of higher investment and spending.

- Signs of recovery in manufacturing and exports, give the hope of a more balanced economy

- The UK economy has signs of flexibility to prevent rising unemployment we are seeing on the continent.

Reasons to be pessimistic in 2014

- The economy is still weak and requires propping up with ultra loose monetary policy

- The EU economy is still very fragile and could cause damage to the UK economy in 2014.

- Elements of the recovery suggest it may not be sustainable, especially the mini housing boom, and the widening trade deficit

- Prospects of more austerity in 2014 could derail the recovery before it is strong enough.

Overall

Probablemente haya más razones para ser optimistas en 2014 que cualquier año desde el inicio de la recesión. Pero aún hay un largo camino por recorrer. No hay garantía de que recuperemos el pico del PIB anterior a la crisis hasta 2015. Sin embargo, el fuerte crecimiento facilita muchas cosas: aliviará la carga fiscal y dará al gobierno un poco más de margen de maniobra.

Relacionado

- Recuperación económica del Reino Unido