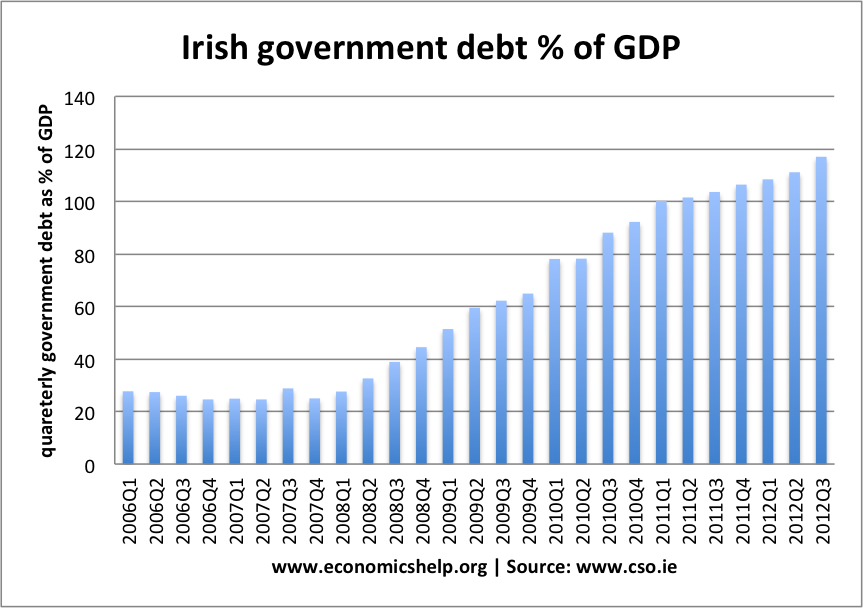

Deuda pública irlandesa: el importe total de la deuda pública irlandesa.

La deuda nacional irlandesa ha aumentado al 117% del PIB en los últimos años debido a un gran rescate financiero a los bancos irlandeses, una profunda recesión que provocó una caída del 20% en los ingresos fiscales nominales y una continua debilidad en el crecimiento del PIB que ha dificultado la reducción de la deuda. al PIB, a pesar de los recortes del gasto público.

Fuente: cso.ie

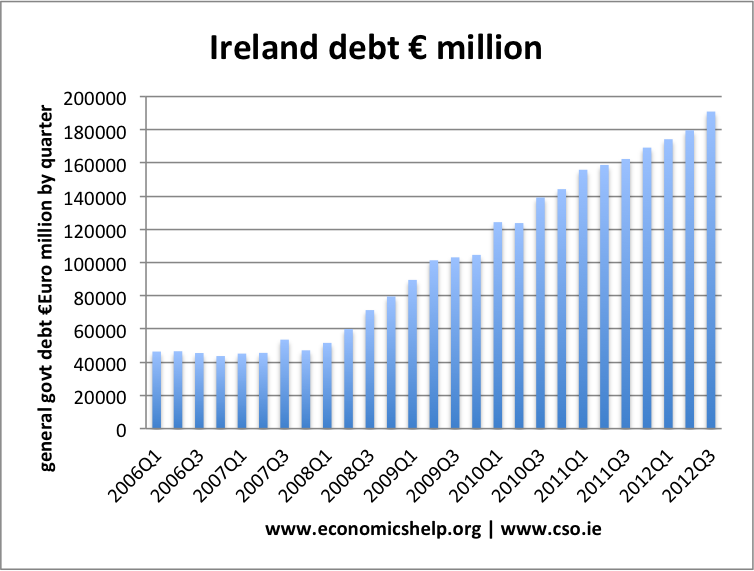

The Total Irish Government debt 2012 Q3 – €190,954 million – (117% of GDP)

Irish government debt millions

See also: stats at ECB (Debt based on – Maastricht assets/liabilities – General government (ESA95) – European Commission – All sectors without general government (consolidation) (ESA95)

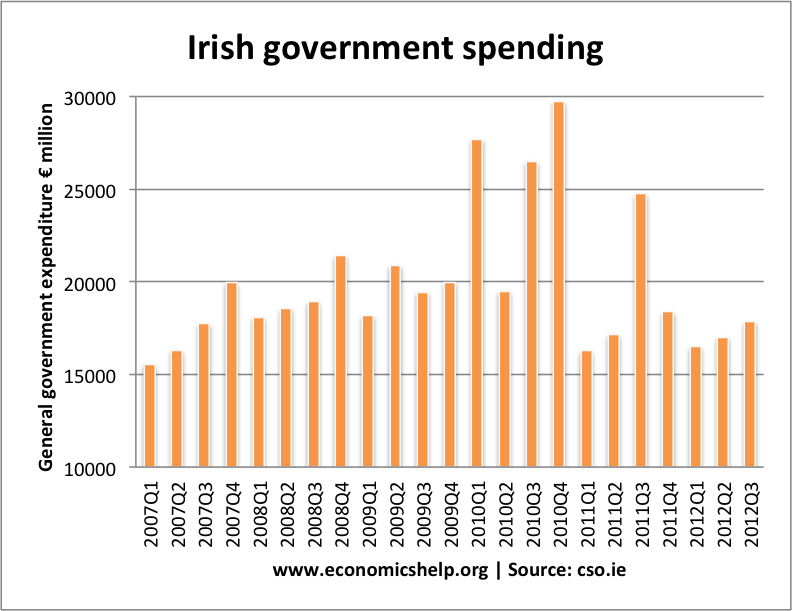

Irish government spending

The peaks in spending in 2010 were related to the Irish government bailout of banks. After the bailout, the government has pursued spending cuts.

Example of spending cuts from 2012 budget at Telegraph

Ireland 2012 budget

– €2.2bn of the €3.8bn of fiscal consolidation is on the spending side.

– Capital expenditure will be cut by €755m, while current spending cuts to contribute €1.4bn. (includes public sector pay, welfare payments, education and health care)

Irish Tax Revenue

Tax revenue fell significantly during the credit crunch.

- In 2007, total tax revenue was €47,887 million. (stats)

- In 2011 tax revenue was €36,801 million which is a 23% reduction and not 20% which is mentioned in the article (stats)

- That is a 23% fall in nominal tax revenues between 2007 and 2011.

Note: These statistics are not adjusted for inflation. The real decrease in tax revenues is even greater.

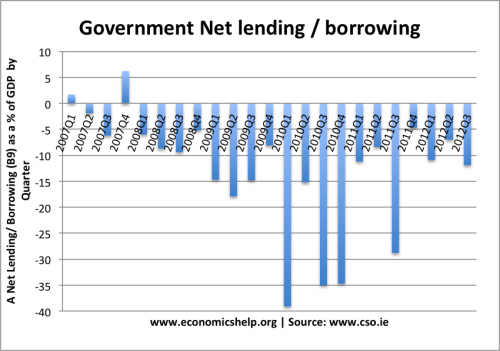

Government deficit

Causes of Irish Debt

- Pre-crisis (2007) national debt – €37.6bn, 19.5% – one of lowest rates of public sector debt in the EU.

- 2008-2013 deficit-related debt – €94.9bn, 49.2% Recession and housing collapse led to significant fall in tax revenues as government received lower income tax, property tax and VAT.

- Banking-related Debt – €60.5bn, 31.4% – cost of bailing out banks, led to record budget deficit of 32% of GDP in 2010.

- Fin facts

- Other put cost of bank bailouts slightly higher at over 70bn Euros (link)

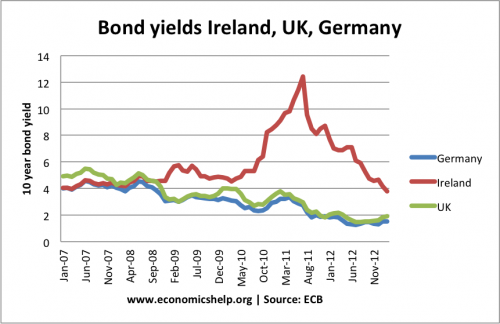

Interest rates on Irish Government Bonds

Bond yields have fallen significantly since 2011 crisis. Helped by ECB intervention, Irish bond yields have fallen to a more manageable 3.8%. ECB long term bond yields

Irish debt back to 1994

External Debt

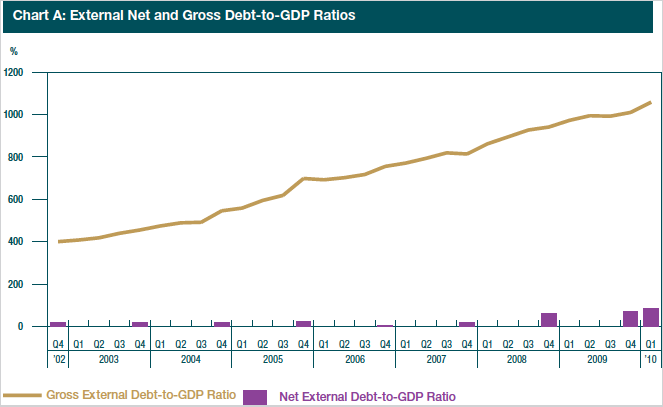

Source: C Bank 2010

Gross External debt to GDP shows the liabilities to non-Irish residents. This amounts to over 1,000 % of GDP march 2010. However, these external liabilities are mostly offset by external assets. e.g. non-banking firms owning foreign assets.

Net External debt, is the difference between external liabilities and external assets. Net external debt has increased to 80% of GDP, Q1 2010. This rise in external debt reflects

- Liabilities to European System of Central Banks (ESCB)

- El crecimiento de las tenencias de bonos irlandeses a largo plazo de inversores extranjeros ha pasado de 29 300 millones de euros a finales de 2007 a 69 500 millones de euros a finales de marzo de 2010.

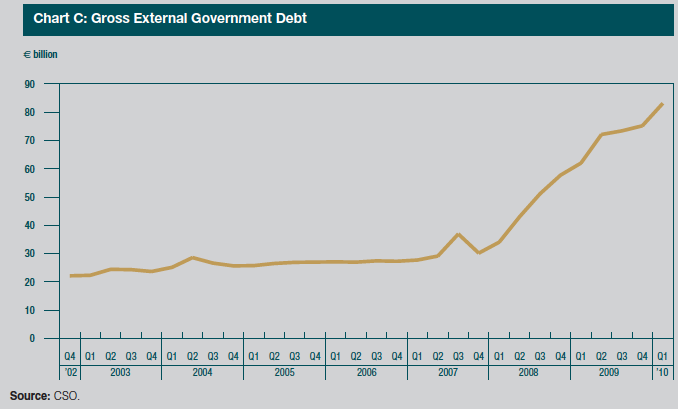

La deuda pública externa bruta ha aumentado de 30.000 millones de euros a más de 80.000 millones de euros en 2010.

Calificación crediticia

- Fitch Ratings BBB + Negativo

- Moody’s Ba1

- Standard & Poor’s – BBB + / A-2.

- Calificación crediticia favorecida por el cambio irlandés de pagarés de 28.000 millones de euros a bonos a largo plazo FT

Relacionado

- Lista de deuda pública por país

- Problemas de la economía irlandesa

- Crisis económica irlandesa

- Datos sobre la crisis de la deuda de la UE

Más estadísticas

Indicadores económicos clave Irlanda – CSO- Resumen del FMI Irlanda